What’s a Credit Bureau Score-How Do Lenders Use Them?

As we show you in this video, a credit bureau score, or “credit score” is a number based upon your credit history that represents the possibility that you will be able or unable to repay a loan.

Lenders use it to determine your ability to qualify for a mortgage loan.

The better the score, the better your chances are of getting a favorable loan.

Credit scoring has changed over the years, and continues to involve new modeling with different credit agencies each using different factors to score your credit behavior.

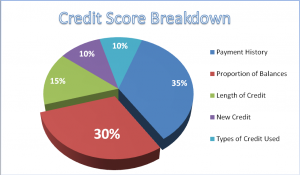

Your credit score is based on a number of factors such as:

- Payment History

- Proportion of Balances to Available Credit

- Length of Credit

- New Credit

- Types of Credit Used

- Negative Reports from Public Agencies for Foreclosure, Bankruptcy, Collections

Knowing your credit score is an important first step to evaluating what you may be able to qualify for in the way of property financing.

For more information about your Credit Score and how Lenders will use the information, please call us at First Title & Abstract, Inc.

We can put you in touch with some of the best lenders in the area who can guide you through the process of evaluating, and improving your credit score.