VISIT THIS LINK FOR INFO ABOUT PAGE 4 OF THE CLOSING DISCLOSURE:

Understanding Your Loan: Additional Information

The information found on Page 4 of your Closing Disclosure is important.

And you won’t find a Naples title company which will take the time to explain these things to you.

But our title attorney on staff, and Naples real estate attorney available for your closing, along with our closers and title agents are very familiar with the new Closing Disclosure form, and all the info it contains.

It is NOT just standardized form with information that is identical for every loan.

It includes important explanations about features of your loan, including:

Assumption: can this loan be transferred to another person if you sell or transfer the property?

- Demand: can the lender require early repayment of the loan?

- Late Payments: what penalty, after what period, applies?

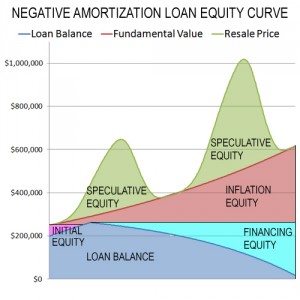

- Negative Amortization: does this loan schedule or allow payments that do NOT fully cover the interest due, resulting in increased loan principal?

- Partial Payments: what is THIS lender’s policy?

You should also review Escrow Account details to understand whether you will pay additional property costs via regular Escrow Account payments or handle them yourself directly.

A trap for many borrowers are those loans with negative amortization.

If your loan has this feature, please contact us, as we can help you fully understand the potential risks associated with such a mortgage.

At First Title & Abstract, Inc., we believe understanding your loan is critically necessary before you sign your paperwork.

We will take the time to make sure you know what you’re signing, before the closing.

Please call our offices in Naples, Florida or Marco Island, Florida, and we will be glad to discuss your loan with you!

First Title & Abstract — “Putting You FIRST!”