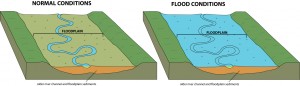

Your Final Walk Through often is your last opportunity to ensure that everything in your home is working, and that the seller has maintained the home as required by the contract up through the date of closing.

This is often the first opportunity to examine the house without furniture giving you a clear view of everything.

Check the walls and ceilings carefully as well as any work the seller agreed to do in response to the inspection. Be sure to check all appliances, garage door opener, security system, and heating and cooling systems to ensure they are working properly.

Any problems you may discover should be brought up prior to the final signing and closing on your property, and may require the seller to complete repairs or provide a credit for the repairs.

Because some negotiation may be involved, it is often best to schedule the walk-through at least one day before closing, and give your professional advisors time to assist you in negotiating the walk-through items. You may also need to have tradesmen complete an estimate for certain repairs to help you decide on an appropriate credit from the seller.

Please keep in mind that some mortgage lenders will not approve credits for repairs. It is good to know generically if your mortgage lender allows repair credits, and will want to consult your loan officer about this long before the walk-through inspection.

In Naples, Florida, First Title & Abstract is the title company of choice for those who want a company with experience in helping buyers and sellers negotiate walk-through issues and complete their closing.

We’ve done it thousands of times, and have the knowledge and experience to assist you, too.

Our attorneys and staff are experts at helping you and your Realtor handle these situations, and we’re glad to offer our experience and assistance.

We look forward to seeing you at closing!