Understanding Your Loan Estimate: Services You Cannot Shop For

These costs are paid to outside parties, not the lender, but you don’t get to choose them. They may include:

- appraisal, which puts a value on your property on the lender’s behalf

- a credit report on you

- fees to assess flood risk of your property, or for ongoing monitoring of flood zone changes related to your property

- tax monitoring to keep track of your property tax payments

- tax status research to assess the state of tax payments on the property.

While you can’t shop for these services, the price for these services in your final loan disclosure MUST match the price on the Loan Estimate; items in “Cannot Shop” have 0 tolerance for change.

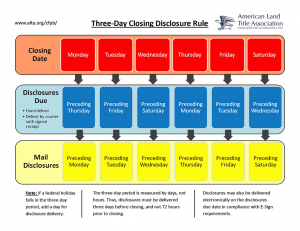

Understanding Your Loan Estimate: Services You Cannot Shop For – Know the Rules under TRID! The disclosures and timelines are for YOUR protection! Call us for help!

Federal laws exist to safeguard consumers during the home-buying process when a mortgage is involved.

If you have questions about any charges during your home-buying process, please contact your friends at First Title & Abstract, Inc.

We’re the title company in Naples and Marco Island which thousands of satisfied buyers and sellers have depended upon for honest and reliable services.

At First Title, we believe in “Putting You FIRST!”